“Presentatievorm minder belangrijk dan methode en individuele kenmerken”

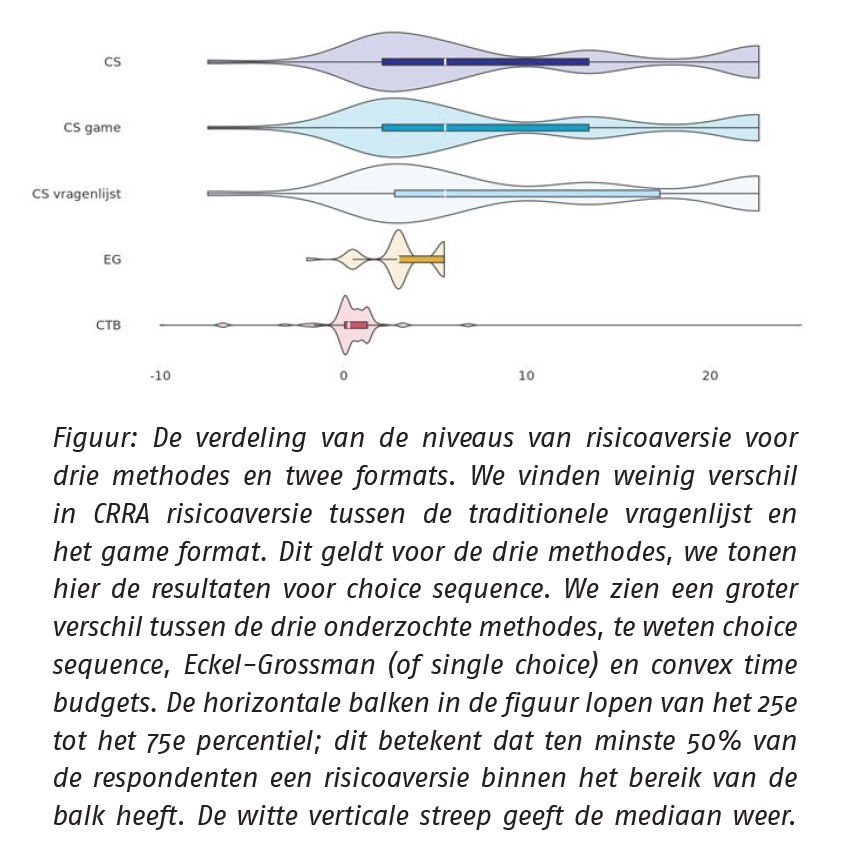

Nieuwe wetgeving verplicht pensioenfondsen en verzekeringsmaatschappijen om minstens eens in de vijf jaar de risicohouding vast te stellen. Hoe een dergelijk risicopreferentieonderzoek wordt gepresenteerd (de presentatievorm) zou het niveau van de gemeten risicoaversie kunnen beïnvloeden en daarmee de beleggingsstrategieën voor diverse groepen. We onderzoeken of dit het geval is onder pensioenfondsdeelnemers in de bouwsector. We bestuderen of risicovoorkeuren gemeten met een serious game anders zijn dan risicovoorkeuren gemeten met een traditionele vragenlijst. We bestuderen drie veelgebruikte methodes om risicovoorkeuren te meten: choice sequence, single choice en convex time budgets.

Kernboodschap voor de sector

- Methodes om risicopreferenties uit te vragen en individuele kenmerken, zoals leeftijd en aard van het werk, hebben meer invloed op de gemeten risicovoorkeuren dan de presentatievorm.