“Hoe om te gaan met inflatierisico’s onderbelicht in Wet toekomst pensioenen”

Bij de invulling van nieuwe pensioenregelingen zijn meerdere instrumenten beschikbaar om in te spelen op verwachte en onverwachte inflatie. In dit paper gaan we in op de effecten van deze instrumenten. Verwachte inflatie kan worden gecompenseerd door een lagere startuitkering te kiezen. Onverwachte inflatie kan worden ondervangen vanuit de solidariteitsreserve mits de inflatieschokken niet te groot en persistent zijn. Belangrijker evenwel is de keuze van het beleggingsbeleid, de beschermingsrendementen en toedeling van overrendementen.

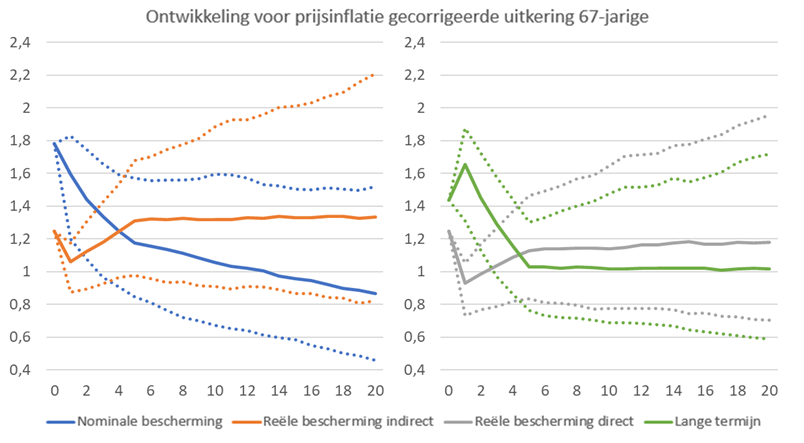

Figuur toont voor verschillende keuzes in projectierendement, beleggingsbeleid en beschermingsrendement

de ontwikkeling van de uitkering gecorrigeerd voor prijsinflatie onder een stochastische simulatie waar in

het eerste jaar een grote inflatieschok optreedt.

Kernboodschap voor de sector

- Nominale beschermingsrendementen en nominaal beleggingsbeleid leiden bij persistente inflatieschokken tot te hoge uitkeringen in de eerste jaren.

- Het beschermen van gepensioneerden tegen verwachte inflatie en inflatierisico’s is doorgaans haalbaar, maar leidt tot lagere uitkeringen in de eerste jaren.

- Inflatiebescherming zou effectiever kunnen zijn door de regelgeving aan te passen.