Better Coinsurance Risk Sharing in Nursing Home Care

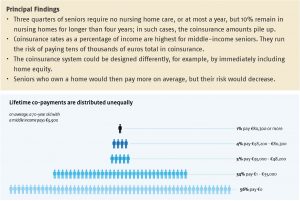

One in five older people in the Netherlands will need nursing home care during their lifetime. Users must pay a portion of the cost themselves, as determined by their income- and wealth-dependent co-payment. This co-payment constitutes a considerable financial risk for middle-class seniors who need long-term nursing home care. For this group, the annual cost of such care can exceed 70% of their net income.

Key Takeaways for the Industry

- By designing coinsurance rates different, the government could limit the financial repercussions of coinsurance without it costing any money.

- The real pressure on income and net worth could be decreased by immediately incorporating home equity and giving the return from this back to seniors in the form of lower contributions from their income or limiting the period for paying coinsurance to a maximum of six years.

- These measures would create significant economic gains for most older people.

Download the CPB backgrounddocument by Bram Wouterse (EUR), Arjen Hussem (PGGM) and Rob Aalbers (CPB) and the infographic (both in Dutch only).