The impact of uncertainty in risk preferences and risk capacities on lifecycle investment

“Full personalisation is not needed for a close to optimal investment policy”

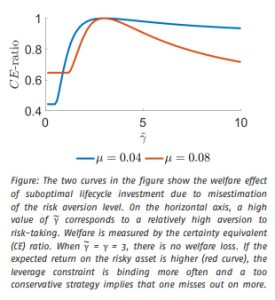

Under new Dutch pension law, pension funds and insurance companies are required to elicit the risk preferences and risk capacities of individual participants and to adjust (collective) investment strategies accordingly. A considerable amount of recent research has studied how the risk preferences and risk capacities of participants can be measured. We go a step further and study the impact of suboptimal lifecycle investments due to changing risk preferences and unanticipated shocks in income. Furthermore, we investigate and quantify how sensitive a participant’s pension outlook is to decisions made earlier in life, which were based on a possibly wrong assessment of risk preferences or future pension contributions.

Key takeaways for the industry

- Strategies that work well under slightly different preferences, personal situations and market environments provide sufficient robustness for near-optimal individual results.

- Leverage constraints or a built-in disability insurance may contribute much more to welfare than the illusion of a perfect match between the individually optimal investment and investments implemented.