Risk Sharing within Pension Schemes

“Buffer fund optimises risk sharing and mitigates downside risk”

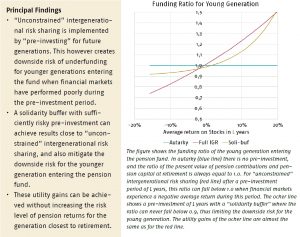

Many countries are reforming their pension systems to facilitate economic and demographic changes. New systems seek to mitigate risks by allocating surpluses to a buffer fund that smooths fluctuations in investment returns and between pension generations. This paper explores optimal risk sharing and assesses the welfare effects of the current Dutch pension proposal against theoretical optimal risk sharing arrangements. We show that a solidarity buffer with sufficiently risky investment provides optimal risk sharing while mitigating negative welfare effects.

Key Takeaways for the Industry

- The new Dutch pension system should incorporate a solidarity buffer to optimise risk sharing and manage the downside risk for younger generations.

- Such an approach will minimise negative welfare effects on both younger participants and participants approaching retirement.