A comparison of risk preference elicitation methods and presentation formats

“Presentation format less important than risk elicitation method and individual characteristics”

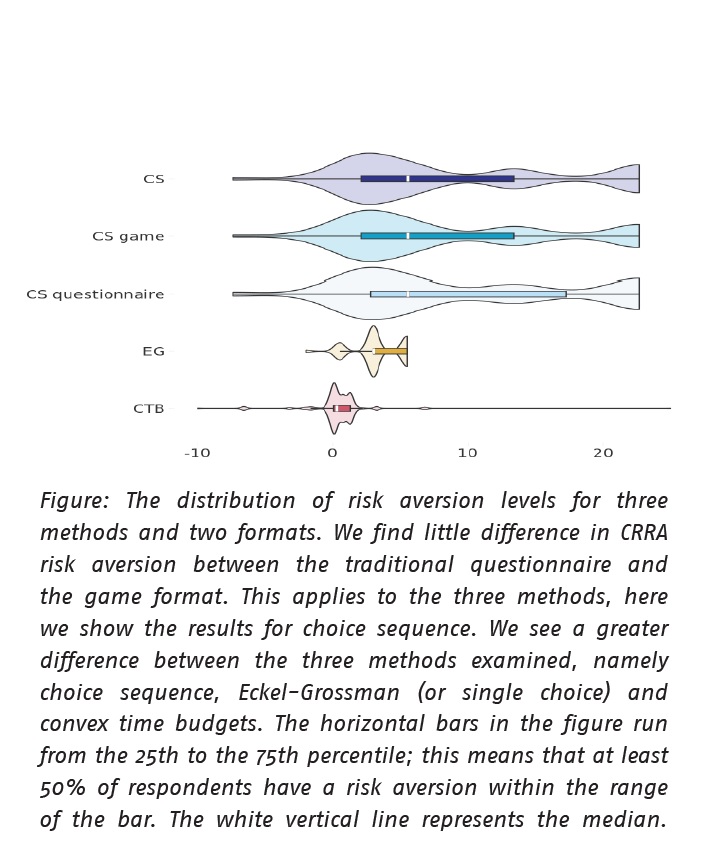

New legislation requires pension funds and insurance companies to elicit risk attitudes at least every five years. How such a survey is presented (the presentation format) could influence elicited risk preferences and consequently the investment strategies for different groups. We investigate whether that is the case among pension fund participants in the construction sector. Our study examines whether risk preferences elicited with a ‘serious game’ are different from risk preferences elicited with a traditional questionnaire. We test this for three risk elicitation methods: choice sequence, single choice and convex time budgets.

Key Takeaways for the Industry

- Risk elicitation methods and individual characteristics, such as age and type of work, influence measured risk preferences more than the presentation format.