The transition to the new Dutch pension system

“This transition is unavoidably affected by future developments on financial markets”

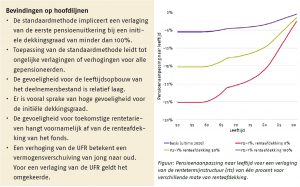

The transition from the current Dutch pension system to the new pension contract means a switch from a benefit scheme to a premium scheme. Pension funds will therefore need to convert collective capital into personal pension wealth and a solidarity reserve. That conversion is sensitive to fund-specific assumptions (such as initial coverage and age structure of the participant population), economic circumstances (interest rate term structure), and policy-related assumptions (such as ultimate forward rate (UFR)). So how should these sensitivities be dealt with in the transition period for the new pension system?

Key Takeaways for the Industry

- The so-called `standard method’ values pension entitlements and converts the funds’ collective capital into individual pension wealth based on a smoothing technique resembling the recovery rules when a fund is under- or overfunded in the current system.

- The sensitivity to future interest rates depends primarily on the amount of interest rate hedging.

Calculation tool

Click here to open the calculation tool used for the standard method.

Want to know more?

Read the paper ‘Transitie: gevoeligheid voor veronderstellingen en omstandigheden’ (in Dutch) by Anne Balter (TiU), Jan Bonenkamp (APG) and Bas Werker (TiU).