Shocks to Occupational Pensions and Household Savings

“Worsening financial position of pension plans drives an increase in savings”

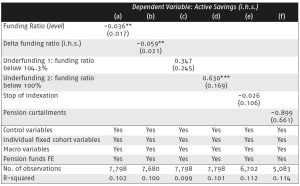

During the COVID-19 pandemic, the mean statutory funding ratio of the entire Dutch pension sector fell by nearly ten percentage points. A survey by De Nederlandsche Bank (Dutch central bank) at that time revealed that this fall caused many households to fear pension curtailments. Could such shocks also affect pension plan participants’ saving decisions? We investigated whether this had already happened during previous crises using a dataset concerning Dutch occupational pension plans for the period 2008-2020, during which two major economic crashes occurred (the global financial crisis and the sovereign debt crisis).

Key Takeaways for the Industry

• Shocks to pension plans have modest but significant effects on participants’ economic and financial behaviour.

• The new Dutch pension system could cause such shocks.

Want to know more?

Read the paper Shocks to Occupational Pensions and Household Savings from Francesco Caloia (VU), Mauro Mastrogiacomo (VU) and Irene Simonetti (UvA).