No pension and no house? The effect of LTV limits on the housing wealth accumulation of selfemployed

“Borrowing constraints do not hamper self-employed more than wage-employed”

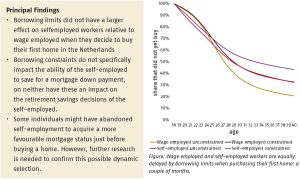

Buying a home could be an attractive alternative to privately saving for a pension, especially for the self-employed. However, this option could be hampered by borrowing constraints introduced in the wake of the Global Financial Crisis. The higher mortgage down payments required could make it harder for the self-employed to become homeowners and therefore acquire wealth. However that has not proven to be the case. Other factors, such as income volatility, make it harder for the self-employed to obtain a mortgage.

Key Takeaways for the Industry

- Policies aimed at monetising home equity after retirement, such as reverse mortgages and cash-out loans, could affect the self-employed more directly.

- Whether young self-employed people are keener to save for a first home than for a personal pension or other pension alternatives remains unclear, but this choice is not specifically affected by borrowing constraints.

Want to know more?

Read the paper ‘No pension and no house?’ by Mauro Mastrogiacomo (DNB, VU) en Cindy Biesenbeek (DNB).