Challenges of automated financial advice: Definition and ethical considerations

“Ethical tools and frameworks can facilitate the implementation of AIbased advice”

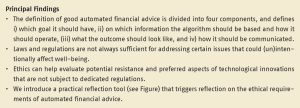

Consumers need to be well-informed about their financial situation to be able to take action when this changes. Automated financial advice could increase consumers’ access to financial advice and, consequently, their financial well-being. Although such advice already exists for various financial products, holistic, automated financial advice has not yet entered the market. This next step requires a definition of good automated financial advice as a basis for financial advice algorithms and a framework to consider the ethical issues involved in implementing such automated advice. Our research explores both of these challenges.

KEY TAKEAWAYS FOR THE INDUSTRY

• An ethical perspective must be applied to automated financial advice during the design phase to address in advance the issues that could jeopardise the adoption of automated services.

• Organisations can use the AI4 Ethical Financial Services (AI4ES) framework we developed to broadly incorporate ethics into their financial services.

WANT TO KNOW MORE?

Read the paper Lees het paper ‘Challenges of automated financial advice: Definition and ethical considerations’ by Robert Gianni (UM), Minou van der Werf (UM), Lisa Brüggen (UM), Darian Meacham (UM), Jens Hogreve (KU), Thomas Post (UM) and Jonas Heller (UM).