Trust in the financial performance of pension funds, public perception, and its effect on participation in voluntary pension saving plans

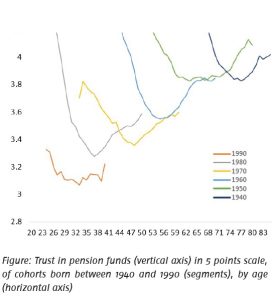

Did the financial performance of pension funds due to the financial crisis affect trust in pension funds? And does our age, birth cohort or the business cycle affect it too? In this paper, we analyze the effect of exogenous shocks in terms of pension cuts, indexation and how they are perceived. We propose the use of two new instruments. These are the level of indexation of the respondents’ occupational pension funds in the DHS population, and their perception (right or wrong) of indexation.

Key Takeaways for the Industry

• Public sentiments about pension funds revolve around the dissatisfaction with the lack of indexation.

• Even if the new system will no longer make promises that might not be kept, it is possible that the adjustment process might create mistrust.

• Pension funds can act on that by explaining the uncertainties surrounding future pensions.