Measuring sustainability of pension with investment game

“Discovering sustainability preferences with an investment game”

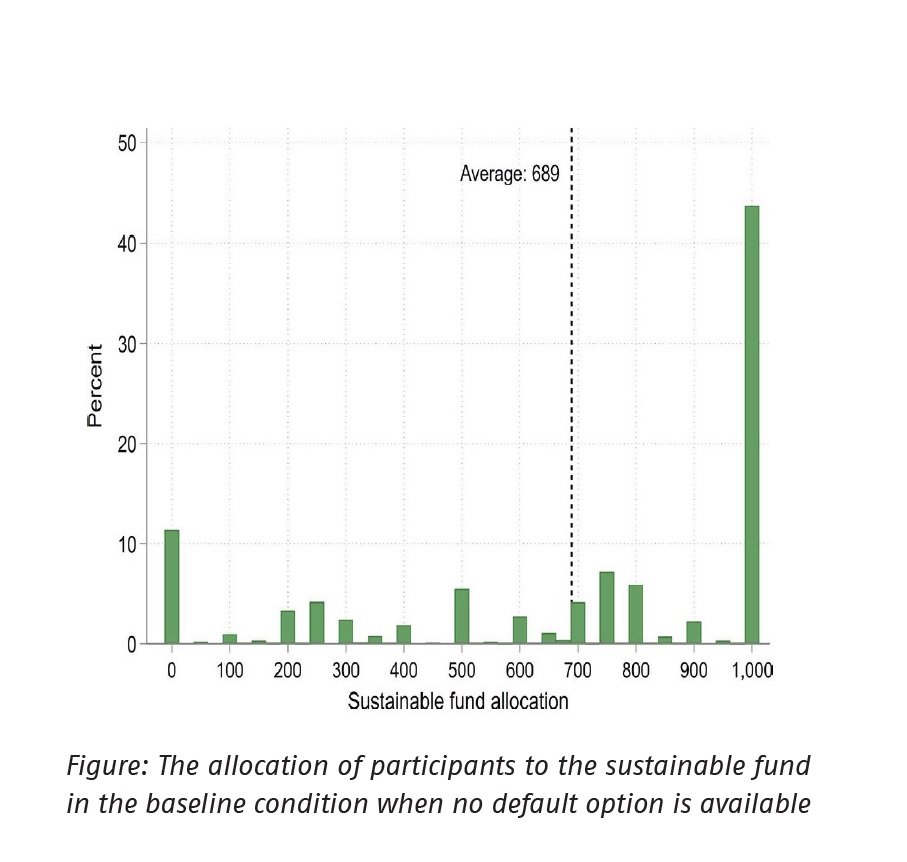

Pension funds increasingly want to know exactly what their participants’ preferences are. To find out how sustainable customers really want to invest, this paper discusses the investment game. Participants reveal their real preferences for SRI during the game. 3,700 customers of a British pension fund participated in the investment game. Participants were given £1,000 to invest, choosing SRI more often than traditional investing.

Key Takeaways for the Industry

• The investment game provides a fairly consistent picture of how sustainably invested participants in a UK fond want to be.

• The investment game could easily be played in the Netherlands as well to investigate how much risk participants are willing to take and how sustainably they want to invest for retirement.