Guarantees in the new pension scheme

“Protection of pension benefits through personal wealth is more transparent and effective than through the solidarity reserve. It also prevents new pay-as-you-go funding.”

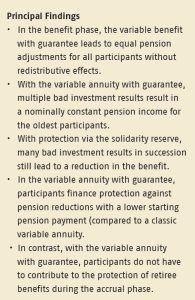

When designing new pension plans, much attention is paid to limiting (the risk of) pension reductions. The so-called Ortec method does this by using the solidarity reserve from which pension income is supplemented, if necessary. We propose an alternative method, the variable benefit with guarantee, which prevents pension reductions through an appropriate implementation of hedge and excess return allocation. This method can eliminate pension cuts altogether. We compare the two approaches in several areas.

KEY TAKEAWAYS FOR THE INDUSTRY

• The Ortec method reduces the probability of reductions, but reductions remain possible.

• The variable annuity with guarantee finances the costs of the protection, without pay-as-you-go financing, on the retirement date and thus prevents possible unwanted effects, for example in the event of value transfer.