Did socially responsible stocks perform better during the COVID-19 crisis?

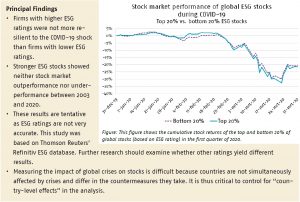

Recent financial media articles and research suggest that the stocks of firms with a stronger environmental, social and governance (ESG) rating might perform better during crises. An extensive analysis of 6,000 stocks in 45 countries during the COVID-19 crisis and a longer-term analysis over 2003-2020 cast doubts on this view. There is little evidence that strong ESG stocks perform better or worse than other stocks, neither during crises nor in crisis-free periods. North America is the exception. There, socially responsible stocks appear to be more resilient during crises.

Key Takeaways for the Industry

- Strong ESG stocks may not have served as “rainy day assets” during crises. That said, they also did not underperform during crisis or over longer periods.

- ESG ratings are less reliable than financial creditworthiness ratings. New research is needed to understand differences between ratings and their relation with stock returns.