Task demarcation: tenability in future pension system

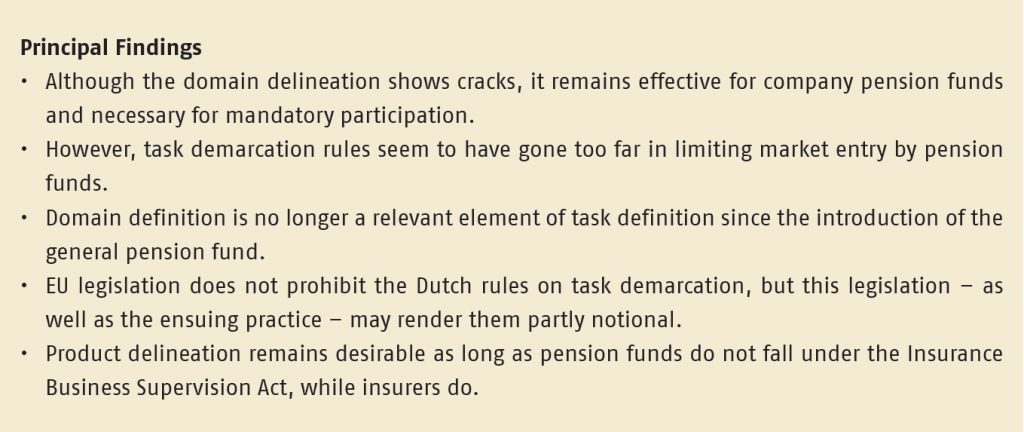

For more than a hundred years, task demarcation rules have prevented unfair competition between Dutch pension funds and insurers by limiting what pension funds could do. However, this system is now showing cracks. This is due to the arrival of pension providers without domain demarcation and the demands of the Future Pensions Act, where there is a blurring of domain rules and a greater emphasis on more individual and additional financial products. We examine the tenability of task demarcation rules in the light of EU legislation, the objective of market organisation and the impact of current developments on the market position of pension providers.

Key Takeaways for the Industry

• Future task demarcation rules need to allow for a more competitive market where tailor-made financial products can meet individuals’ pension requirements.

• Furthermore, these rules should reflect that pension funds are now subject to far-reaching supervisory rules under EU law.

Want to know more?

Read the paper (in Dutch) ‘Taakafbakening: houdbaarheid in toekomstig pensioenstelsel’ by Erik Lutjens and Hans van Meerten.