Stated product choices of heterogeneous agents are largely consistent with standard models

“Standard theory a solid starting point for individuals to characterize individual preferences for pension products”

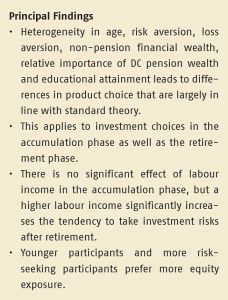

Under the new Dutch pension law, providers of flexible pension contracts have an important role in nudging participants to adequate choice of pension products based on observable characteristics, such as age, income, non-pension financial wealth, risk aversion, gender and marital status. We analysed data on the choices made by relatively experienced participants with a higher level of education to test how well standard models of portfolio choice predict the choice for an investment strategy.

Key Takeaways for the Industry

- Risk aversion plays an important role in explaining product choice, but the industry does not have to limit itself to this variable only.

- Economic variables that measure risk capacity should be considered too.

Want to know more?

Read the paper ‘Stated product choices of heterogeneous agents are largely consistent with standard models’ by Bart Dees, Theo Nijman and Arthur van Soest (Tilburg University).