Pension Communications in Flux! Review of Five Online Inspiration Sessions

Research has shown that there is much ground to be gained in terms of building retirement awareness. Effective communications remains pivotal to that and is also a major element in the new pension agreement. That is why Netspar joined together with the Federation of Dutch Pension Funds, the Dutch Association of Insurers, and the Dutch Money Wise platform to host five online inspiration sessions on the science and practice of pension awareness, communications, guided choice, and motivating participants.

About 200 people took part in these five parallel sessions. Since the sessions were only open to a limited number of attendees, who could only choose two to attend, we decided to summarize the most important takeaways from each session for a broader audience. You can also download the presentation slides or check out the links to the background research and watch the info videos.

1. Individual Retirement Decisions in Uncertain Times

Both pension participants and administrators increasingly face greater uncertainty regarding pensions. What exactly do participants need to make good retirement decisions? And what is the best way to support them in that? In this session, Bas Donkers (Erasmus University Rotterdam) and Koen Vaassen (Achmea Pension Services) took us through the theory and practices of decision support as related to retirement decisions. To make good decisions, you need to know what you want to achieve in the future and what you need to accomplish that. It is thus a combination of preferences – the domain of the participant – and financial knowledge – the domain of the experts.

Impact of Decisions

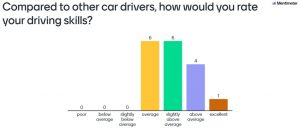

Economics has a wonderful formula for this: the life cycle. That is much too complicated for the average person, however, as also evident from the poll taken during the session. A somewhat “better” score was achieved on the question of how much pension and retirement savings you think you will need later on and how sure you were of this. So what is a handy way of putting that life-cycle model into practice in order to support more participants in their decisions? Conclusion: Support works primarily when it provides insight into the deliberation between risk and return. Moreover, this should not be done by trying to explain to participants the mechanics of what goes on, but by showing the impact of decisions made, that is to say, the results.

Serious Business

Achmea Pension Services developed its Investment Risk Scale with that in mind. The most important tips in the development process were to: make sure it is understandable to participants; keep it short; and avoid getting too cute with the design, because pensions are serious business. Are Bas and Koen finished? Not at all, because their next research projects are already lined up: Goal activation and Option value. These will delve into what people want to achieve and what the value of flexibility is. Interesting topics for a subsequent webinar!

See the slides from this presentation here (in Dutch)

Read more about Bas Donker’s Netspar research project on pension choices in uncertain times.

2. Procrastination and Retirement: Motivating Participants Is Not the Ultimate Goal

It is generally well known and accepted that planning for retirement is extremely important. Yet, many people remain passive when it comes to doing so. Why are people so unknowing about their pensions and retirement savings? Do we have to work even harder to motivate them? And how do you do that? Marijke van Putten (Leiden University) and Job Krijnen (AFM) do not believe that all inactive pension participants fall in the same boat, though. There are, of course, people who do familiarize themselves with their pension and retirement options and knowingly fail to take action…

- Offering frameworks for taking action is important, but motivating participants is not the ultimate goal. It is a means of helping them prepare for a good retirement.

- It is important to know people’s motives for making or not making active decisions. For example, research has shown that many people will choose not to change healthcare insurance providers based on erroneous assumptions. They think it will take them hours to sort out the necessary information, when in reality it barely takes one hour. Once you know that, you can capitalize on such insights and thus steer people’s behavior.

- It is essential to also realize that merely getting people to take action does not mean the decisions will automatically work out. Especially when people lack knowledge or are unsure about a topic, they tend to choose the standard option even if it is not the best fit for their personal situation.

- Ideally, then, you would be able to guide both active and passive decision makers in the best possible manner, with the two not being mutually exclusive. Passive decision makers are best led to a sort of “escalator,” where they can make progress with very little effort. And those who prefer to be on the move will naturally take the stairs.

Download the slides from this session here (in Dutch)

To learn more about our research into retirement passivity, watch this wrap-up (English) from the Netspar Thematic Conference From inertia to guided choice”:

3. Communications about Expected Pension? Participants Want Simplicity!

People only love what they know, according to research from the Dutch marketing firm MWM2 and the Federation of Dutch Pension Funds. Due to a lack of knowledge, for instance, many Dutch people incorrectly believe that they will receive less pension than what they have paid in. How can we turn that around? Marjolein Eigenfeld and Michiel van Rossum (MWM2) plumbed the research to find no fewer than ten principles of effective pension communications, four of which they spotlighted in this session:

- Retirement is an emotional subject and communications about it need to reach participants on that level. Much of the thought processes involved are unconscious. What people want to know is: When? How much? Is it enough for a carefree retirement?

- One size does not fit all. Knowledge, attitude, and behavior vary according to age. People under the age of 45 are interested in the amount they must work toward: are they on the right path? People over the age of 45 want to know “What do developments mean for me”? What have I accrued; can I stop working sooner; and what impact would that have on my standard of living?

- Simplicity is key: strike the right balance between content and simplicity. Show information in a layered format. Make it extremely simple without talking down to people. Use colors that reinforce the message. Provide a total overview, ease of use, and a minimum of fuss.

- Make it attractive, accessible, and fun. An example of this would be congratulatory emails (“so many months to go until retirement”). Or compare the pension to a mortgage or personal savings. And… not all of the photos have to be of joyous retirees…

4. A New Look for Mijnpensioenoverzicht.nl: User Centric

Doris de Jager (Digital Agency Mirabeau) and Kim Liefhebber (Digital Agency Mirabeau) did a presentation on the thorough revamping of the heavily trafficked website mijnpensioenoverzicht.nl (MPO). This was predicated on a comprehensive user survey, which yielded vital information on the areas in need of improvement. User testing provides instant insights and can be quickly and easily implemented, even during a pandemic. How does it work?

|

|

The end result is a crisp, contemporary, and manageable website, as the attendees to this online session will attest. That includes customization options such as language preference, age-specific information, and addressing users by name for an even better online experience.

Watch the slides from this session here (in Dutch)

5. Why Reinvent the Wheel? International Insights into Pension Communications

For four years now, the Dutch Money Wise platform and Maastricht University have explored the practical implications for pension communications of the findings from leading international research. Indeed, we can learn a great deal from one another around the world, only a small portion of which we were able to discuss:

|

|

Download the slides from this presentation here (English)

Maastricht University and the Dutch Money Wise platform have translated their years of research into succinct, highly readable publications, which are available here (in Dutch and English).

See also Thomas Post’s website.