“Duurzaamheidsvoorkeuren ontdekken met een beleggingsspel”

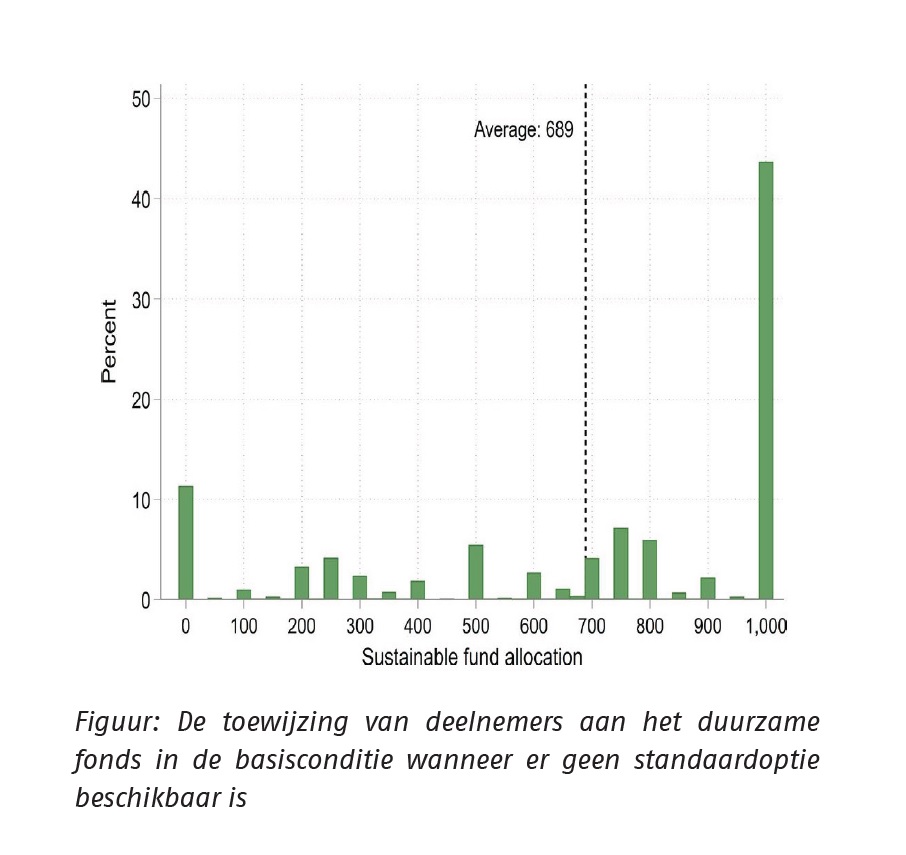

Pensioenfonden willen steeds vaker weten wat precies de voorkeuren van hun deelnemers zijn. Om erachter te komen hoe duurzaam klanten nu echt willen beleggen, bespreekt dit paper het beleggingsspel. Deelnemers geven tijdens het spelen hun werkelijke voorkeur voor duurzaam beleggen bloot. 3700 klanten van een Brits pensioenfonds deden aan het beleggingsspel mee. Deelnemers kregen £1.000 om te investeren en kozen daarmee vaker voor duurzaam beleggen dan voor traditioneel investeren.

Kernboodschap voor de sector

• Het beleggingsspel geeft een vrij consistent beeld over hoe duurzaam deelnemers in een UK willen beleggen.

• Het beleggingsspel kan ook eenvoudig in Nederland worden gespeeld om een indruk te krijgen hoeveel risico deelnemers willen nemen en hoe duurzaam zij willen beleggen voor hun pensioen.