Trust in pension funds: the importance of being financially sound

“Pension funds with large buffers are associated with a high level of trust”

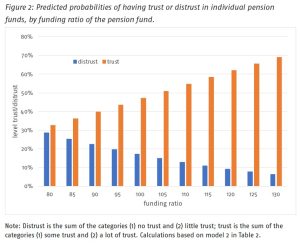

Until they retire, pension fund participants do not know whether the premiums they paid during their employment were well spent. They need to trust pension funds to invest their premiums wisely. That trust cannot be taken for granted. Pension funds are aware of the fact that any failure to deliver on their promises will result in a loss of trust and financial stability. Policymakers and CEOs often assume that certain financial actions or regulations will increase trust. We tested this assumption by examining how participants’ trust in their pension fund is related to the financial health of their fund.

Key Takeaways for the Industry

• Financial buffers of participants’ own pension funds generate trust.