Trust and Distrust in Pension Institutions in Times of Decline and Reform

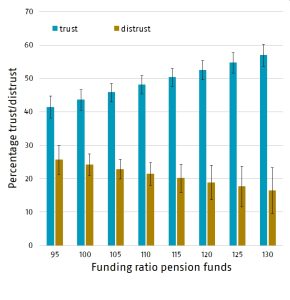

“Funding ratio is a significant driver of trust in pension funds”

Participants’ trust in pension intstitutions (pension funds and government) is crucial because pension providers try to fulfil their pension promises in a fundamentally uncertain world. Therefore, buffers are necessary to cover shocks, like the Great Recession, in order to make good on those promises. But, do shocks to financial buffers, like the funding ratio and the public debt ratio, really affect the trust of citizens in pension funds and the government?

Key Takeaways for the Industry

- The funding ratio matters in generating trust in pension funds.

- A higher funding ratio is associated with a higher level of trust, but mistrust does not diminish to the same extent.