The demand for retirement products: the role of withdrawal flexibility and administrative burden

“Current pension products not flexible enough for many of the selfemployed”

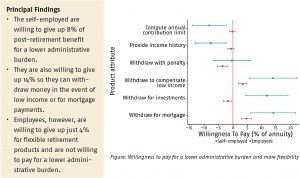

About 40% of the self-employed in the Netherlands save too little for their retirement. Currently, they are more likely to invest in a house or put money aside in flexible savings than invest in a pension product. 48% of the self-employed don’t know how to calculate their annual contribution limit, which can deter the self-employed from investing in pension products. Could offering the self-employed pension products with a greater withdrawal flexibility and lower administrative burden encourage them to save more for their retirement?

Key Takeaways for the Industry

- Demand for the fiscally attractive pension products with increased withdrawal flexibility and reduced administrative burden is higher for the self-employed than employees.

- Abolishing the need to provide financial information to purchase annuities below a given threshold may boost the pension savings of the self-employed and lower-income workers in particular.