Accumulation of choices; interactions in choice architecture and between time and risk

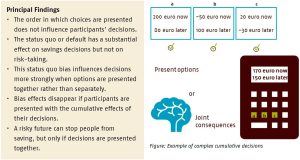

“The status-quo bias is stronger when options are presented together rather than separately, however the bias disappears if the joint consequence of options are shown.”

As a result of the new pension agreement, Dutch pension participants face an increasing number of pension choices during the accumulation of their pension and in how it is paid out. Participants’ choices have cumulative consequences, which they often do not understand or fail to oversee. Is that cumulative effect influenced by how the choices are presented, such as the order of presentation or which elements are presented together? And can interactions between these elements occur that affect the investment and savings decisions taken?

Key Takeaways for the Industry

- Participants are inclined to save less if they cannot oversee or reduce the risk involved.

- Therefore informing participants about the cumulative effect (end situation) of their choices is more helpful than merely informing them of all options available.

- The status quo bias is substantially stronger when choices are presented together rather than separately.