Risk-taking behavior after experiencing a disaster; implications for pensions

“Disaster leads to long-term risk aversion for younger people and hence potential pension loss”

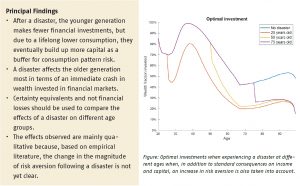

This study used a well-known standard life cycle model to analyse the influence of a disaster like COVID-19 on the optimal consumption and investment strategy of different generations. The model assumes an individual without higher education, unmarried and no children, and that the disaster affects the risk tolerance. The ages examined were 25, 50 and 75 years. Risk aversion increased after a disaster, and the younger generation was hit the hardest.

Key Takeaways for the Industry

- If generations are compared in terms of their certainty equivalent, younger generations lose more in utility terms after a disaster.

- Pension providers could consider reducing the aggregate loss in utility due to the COVID-19 pandemic by compensating younger generations at the expense of older generations.