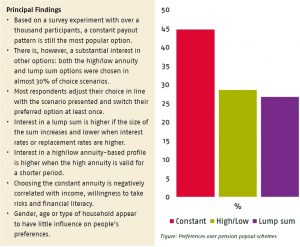

Pension payout preferences

“Clear interest in options other than default constant payout pattern”

In the debate about the new Dutch pension system, much attention has been paid to increasing participants’ choices. The default pension payout is a lifelong flat monthly rate (constant payout pattern). However, other options are (becoming) available such as a high/low annuity based profile or a partial lump sum at retirement with a lower monthly rate later. How appealing to retirees are these different payout options, and what influences these preferences?

Key Takeaways for the Industry

- Given the current low to absent indexation of pensions and low interest rates, the planned introduction of the lump sum option in 2023 could see a fair amount of uptake.

- Pension providers can help participants make a more informed choice by actively presenting personalised information about their payout options.