Managing inflation risk in the New Dutch Pension Contract

“Protecting new pensions against inflation is a realistic option”

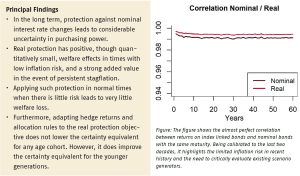

Draft texts for the Wet Toekomst Pensioenen (Dutch Future of Pensions Act) often mention maintaining purchasing power but devote limited attention to the risk of inflation. This is hardly surprising because, since the late 1990s, inflation has been very moderate without large persistent shocks. However, for the future inflation risk remains an important risk factor. We investigated various options for hedging against inflation and unexpected inflation shocks in the New Pension Contract. And we assessed the impact of these measures on pension outcomes.

Key Takeaways for the Industry

- Policy decisions should incorporate inflation risks.

- Conventional scenarios should be critically evaluated with respect to inflation scenarios.

- The New Pension Contract should include possibilities to manage inflation risks via real ‘projection’ rates and real hedge returns.

- The impact of inflation risk sharing on other cohorts within the pension fund should be investigated.