Labour market effects of the pension premium system

“Progressive pension contributions may mitigate transition effects, but also adversely affect pension benefits and labor participation of older workers”

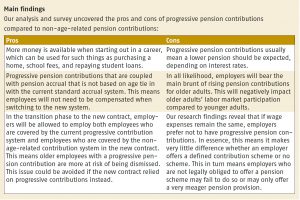

Most Dutch pension schemes currently require all participants to pay the same contribution percentage and ensure everyone has the same accrual percentage. Younger adults, however, have a much longer investment horizon. This means that each euro a younger adult invests will generally yield more pension than the euro of an older adult. The new pension contract ensures that pension contributions are not age-related and that accrual increases with age. Yet, there are certain issues associated with this transition process. One solution might be progressive pension contributions, meaning the contribution percentage increases with age. This study investigates the implications of progressive contributions for the labor market, based on the academic literature as well as on a survey held among employees.

Main takeaway for the sector

- The non-age-related pension contributions in the new pension contract will create some difficult issues in the transition period.

- Progressive pension contributions, however, would negatively impact pension levels as well as older adults’ labor market participation.