Investment risk with guarantees after retirement?

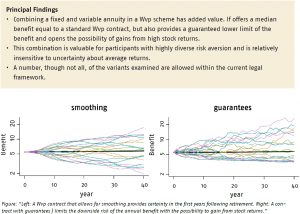

“Combining a fixed and variable annuity has added value for participants”

The Premium Schemes (Improvements) Act (Wet verbeterde premieregeling, Wvp) allows for continued investing following a person’s retirement date, but this is not without risks. We assess a number of continued investment strategies via a simulation study based on financial scenarios of De Nederlandsche bank (the Dutch central bank). We compare alternative ways of managing and spreading equity risk over time. We also study the effect of interest rate shocks on the benefits and indicate how the interest rate risk can be partially hedged.

Key Takeaways for the Industry

A contract with a guaranteed pension, for example 75% of a fixed annuity, is an appealing option when it is difficult to determine risk aversion and time preference of participants.