Income effects at and after the transition to the new Dutch pension contract

“The new pension contract affords the flexibility to tailor pension incomes to participants’ preferences”

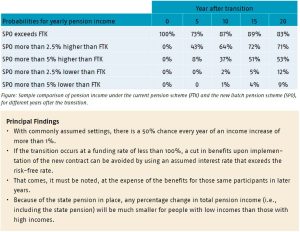

How will the collective investment strategy, allocation of total returns, assumed interest rate, and smoothing term affect pension incomes under the new Dutch pension contract? We examined the income effects at both the time of transition to this new scheme and in the longer run. We also compared the income generated under the current scheme (FTK) to that under the new scheme (SPO).

Key Takeaways for the Industry

- Under the new system, income profiles can be adjusted to the preferences of the participants and other parties involved according to the collective investment policy, allocation of total returns, assumed interest rate, and smoothing term used.

- A dashboard is presented for comparing income profiles based on the different choices used.