To what extent can partial retirement ensure retirement income adequacy?

“Partial retirement allows to reduce workload and maintain an adequate pension income.”

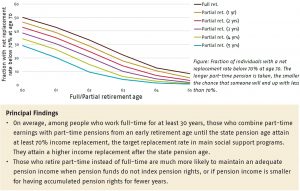

Partial retirement before the state pension age allows people to reduce workload and maintain an adequate pension income at the same time. After a career of full-time work, those who retire part-time instead of full-time are much more likely to attain an income replacement of 70% during partial retirement, and subsequently a higher income replacement during full retirement. They are also much more likely to maintain an adequate pension income when pension funds do not index pension rights, or when pension income is smaller due to accruing pension rights for fewer years.

Key Takeaways for the Industry

- Part-time retirement allows people who do not want to work full-time until the state pension age to maintain an adequate pension income, e.g. those working in physically demanding jobs.

- Now that there are fewer institutional incentives to stop working earlier, part-time pensions may play a greater role in phasing out the working life in the coming years.

- Part-time instead of full-time retirement before the state pension age is beneficial for public finances as people with part-time pensions generate pension contributions and taxable income for more years.

Want to know more?

Read the paper of Tunga Kantarcı (Tilburg University) and Jochem Zweerink (CPB) ‘To what extent can partial retirement ensure retirement income adequacy?’