The Effect of the Dutch Financial Assessment Framework on the Mortgage Investments of Pension Funds

“Mortgage investments help to boost pension funds’ performance”

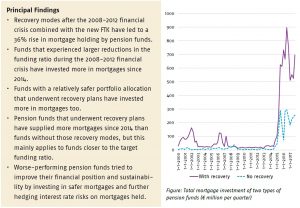

Following the financial crisis of 2008-2012, the Netherlands published the new Financial Framework (FTK) in 2014 to make Dutch occupational pensions more sustainable, stable and resilient. Since the framework’s publication, mortgage holding under pension funds has soared as they have sought to recover from the crisis and improve their financial performance. Low interest rates have contributed to this trend but only to a modest extent.

Key Takeaways for the Industry

- Pension funds have invested more in mortgages since the financial crisis to reduce their risks and improve their financial performance.

- However, mortgage investments remain a relatively small component of overall pension fund investments.

Want to know more?

Read the paper ‘The Effect of the Dutch Financial Assessment Framework on the Mortgage Investments of Pension Funds’ by Yeorim Kim and Mauro Mastrogiacomo (VU Amsterdam and DNB).