Pension choices: implications of a heterogenous participant population on the pay-out stream

“Participants’ freedom of choice should not lead to undesirable pension pay-out situations”

Individuals can influence the drawdown rate of their second-pillar pension assets in various ways. This paper studies how choices offered by Dutch pension funds impact the payout stream. We show that too much freedom of choice could potentially lead to undesirable situations where the participant receives far less pension compared to the benchmark case (no choices exercised). One possible way to avoid this, is to apply the principle of conditional freedom of choice: participants can use their pension assets as they wish, as long as certain conditions are met and remain met.

Key Takeaways for the Industry

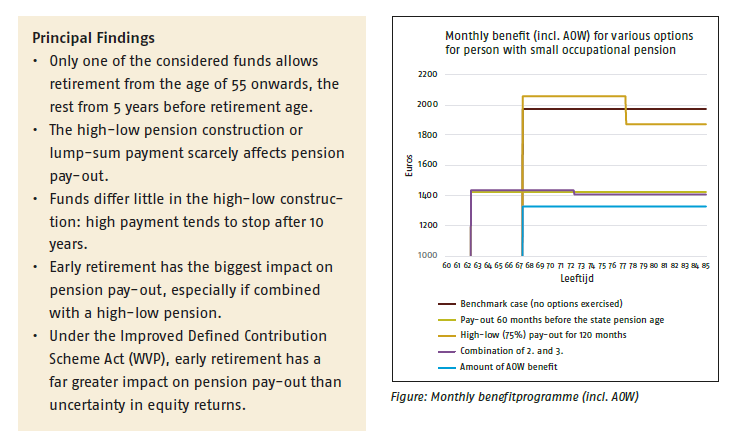

- Early retirement has the biggest impact on the pay-out stream, especially for participants with little accrued pension rights.

- Allow for conditional freedom of choice so that pension funds can do justice to the heterogeneity in individuals’ incomes and assets.

Want to know more?

Read the paper by Servaas van Bilsen (UvA), Johan Bonekamp (TiU) and Eduard Ponds (APG) Keuzes rondom pensioen: implicaties op uitkeringssnelheid voor een heterogeen deelnemersbestand. (Nederlandstalig)