Payment effects and cost-covering premiums in the new surviving dependants’ pension

“New proposals will lead to additional DP income for low-income groups”

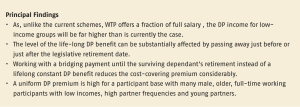

If proposals in the new Future of Pensions Act (Wtp) are accepted, surviving dependants’ pensions (DP) will radically change in the Netherlands. The diverse range of schemes currently on offer will be standardised, thereby improving transparency. This study considers the impact of the proposed changes on DP payments and cost covering premiums and offers suggestions to mitigate the loss of pension capital if a former employee passes away before the retirement date.

Key Takeaways for the Industry

Key points to be considered when implementing the Wtp proposals are:

- higher costs of a fiscal maximum DP;

- risk of assets accrued for surviving dependants’ pension lapsing in the event of uninsured death;

- effects of a choice for voluntary continuation of DP after employment ends;

- differences in lifelong DP benefit that can occur in the event of death just before or after the retirement date.

Want to know more?

Read the paper ‘Payment effects and cost-covering premiums in the new surviving dependants’ pension’ van Sander Muns, Theo Nijman and Bas Werker – Tilburg University.