Investing for Retirement with an Explicit Benchmark

“Non-constant risk aversion in investment reduces uncertainty about pension capital”

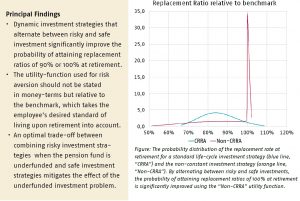

A disadvantage of defined contribution schemes, like those in the new Dutch pension deal, is the considerable uncertainty about pension capital at retirement. This is caused by the investment strategies used, which maximise the return with a constant relative risk aversion. This study explored the impact of using a non-constant relative risk aversion, which allows investment strategies that explicitly try to achieve the benchmark pension capital at retirement. We found that this approach gives a high chance of obtaining the desired benchmark, thereby reducing participants’ uncertainty about their pension income.

Key Takeaways for the Industry

- Direct contribution pension schemes that use a stochastic benchmark with a non-constant risk aversion provide significantly lower uncertainty about pension capital at retirement compared to traditional life cycle investment strategies.

Want to know more?

Read the paper ‘Investing for Retirement with an Explicit Benchmark’ by Anne Balter¹, Lennard Beijering², Pascal Janssen³, Frank de Jong¹, Agnes Joseph⁴, Thijs Kamma⁵, and Antoon Pelsser⁵ ⁶ – ¹ TiU, ² Zanders, ³ PGGM, ⁴ Achmea, ⁵ UM, ⁶ UVA.