Drawing up the bill: Does sustainable investing affect stock returns around the world?

“No systematic relation between ESG and worldwide stock returns during past two decades”

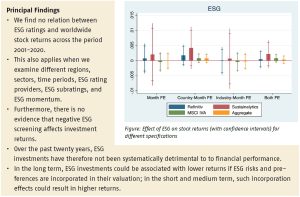

Sustainable investing is on the rise, and institutional investors increasingly take ESG (Environmental, Social & Governance) considerations into account in their investment strategies. There is still a lot of discussion about the consequences of this for financial returns. So far, the thousands of studies conducted about this subject have yielded conflicting results due to major differences in the choice of ESG ratings, empirical methods and markets and time periods studied. This comprehensive global study into the ESG ratings of different providers yields several clear answers.

Key Takeaways for the Industry

- It seems unlikely that we are in an ESG bubble caused by a widespread overvaluation of sustainable stocks.

- Claims that sustainable investments lead to higher financial returns should be viewed with a healthy dose of scepticism.

Want to know more?

Read the paper ‘Drawing up the bill: Does sustainable investing affect stock returns around the world?’ by Romulo Alves (SKEMA Business School), Philipp Krueger (University of Geneva) and Mathijs van Dijk (Rotterdam School of Management, Erasmus University).