Pensions after the mandatory industry wide schemes

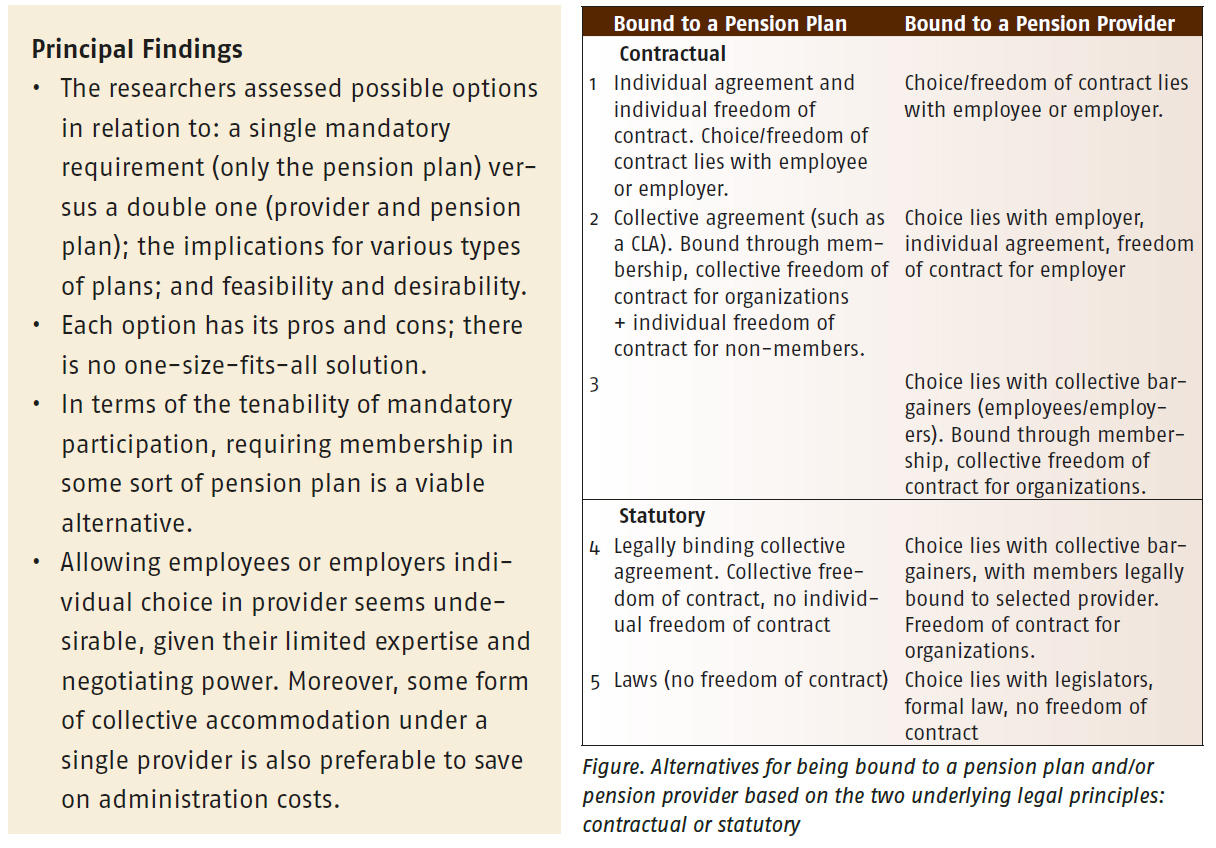

One of the strengths of the Dutch pension system is the mandatory participation by workers in an industry pension fund. However, questions are being raised about the form this currently takes, whereby all the employers and employees in a particular industry partake in the same pension plan with a mandated pension fund as provider. A study into possible alternatives reveals that by making the pension plan mandatory instead of the fund, the social partners’ freedom of contract can be respected, while preventing an increase in the number of employees either without a pension plan or with a poor one.

Key message for the sector

- Some form of mandatory participation is needed to ensure that as many people as possible have a good pension plan. More research is needed to determine the best form for that.

- Concerns about the tenability of mandatory participation, as related to competition law, would no longer be an issue if it were the pension plan itself that was mandatory instead of the pension fund.

Want to know more?

Download the paper “Alternatieven voor de huidige verplichtstelling van bedrijfstakpensioenfondsen” of Fieke van der Lecq and Erik Lutjens (VU Amsterdam).